In the competitive landscape of mortgage lending, leveraging the best CRM for mortgage lenders is crucial. These specialized systems empower lenders to streamline operations, enhance customer experiences, and achieve unparalleled success.

By implementing a robust CRM, mortgage lenders gain access to a comprehensive suite of features tailored to their unique needs, enabling them to manage applications seamlessly, track loan progress efficiently, and automate workflows effectively.

Key Features for Mortgage Lenders

Mortgage lenders require a comprehensive CRM system that addresses their specific needs. These systems should provide features that streamline mortgage applications, track loan progress, automate workflows, and integrate with other software.

Essential features include:

Mortgage Application Management

- Lead capture and qualification

- Application tracking and status updates

- Document management and electronic signatures

- Loan origination and underwriting

Loan Progress Tracking

- Loan status tracking and notifications

- Loan milestones and timelines

- Automated loan approval and denial notifications

Workflow Automation

- Automated task assignments and reminders

- Automated email and SMS notifications

- Automated document generation and distribution

Software Integration, Best crm for mortgage lenders

- Integration with loan origination systems (LOS)

- Integration with document management systems

- Integration with other business systems

Comparison of Leading CRM Solutions

Mortgage lenders have a unique set of needs when it comes to CRM software. They need a solution that can help them manage their leads, track their pipeline, and close more loans. In this section, we’ll compare the leading CRM solutions specifically designed for mortgage lenders.

We’ll look at their key features, pricing, and customer reviews to help you choose the best solution for your business.

Leading CRM Solutions for Mortgage Lenders

- Salesforce Financial Services Cloud

- Microsoft Dynamics 365 for Finance and Operations

- Black Knight Loan Origination System (LOS)

- Ellie Mae Encompass

- Cloudvirga Mortgage CRM

These solutions all offer a range of features that are essential for mortgage lenders, including lead management, pipeline tracking, loan origination, and customer relationship management. However, they also have some key differences in terms of pricing, functionality, and ease of use.

Pricing

The pricing of CRM solutions for mortgage lenders varies depending on the features and functionality that you need. Salesforce Financial Services Cloud and Microsoft Dynamics 365 for Finance and Operations are typically the most expensive solutions, while Cloudvirga Mortgage CRM and Ellie Mae Encompass are more affordable options.

Functionality

The functionality of CRM solutions for mortgage lenders also varies depending on the vendor. Salesforce Financial Services Cloud and Microsoft Dynamics 365 for Finance and Operations offer the most comprehensive range of features, while Cloudvirga Mortgage CRM and Ellie Mae Encompass are more focused on specific areas of mortgage lending.

Ease of Use

The ease of use of CRM solutions for mortgage lenders is also an important consideration. Salesforce Financial Services Cloud and Microsoft Dynamics 365 for Finance and Operations are both complex solutions that require a significant investment in training and implementation.

Cloudvirga Mortgage CRM and Ellie Mae Encompass are more user-friendly solutions that can be implemented more quickly and easily.

Customer Reviews

The customer reviews of CRM solutions for mortgage lenders can also be helpful in making a decision. Salesforce Financial Services Cloud and Microsoft Dynamics 365 for Finance and Operations have both received positive reviews from customers, while Cloudvirga Mortgage CRM and Ellie Mae Encompass have received mixed reviews.

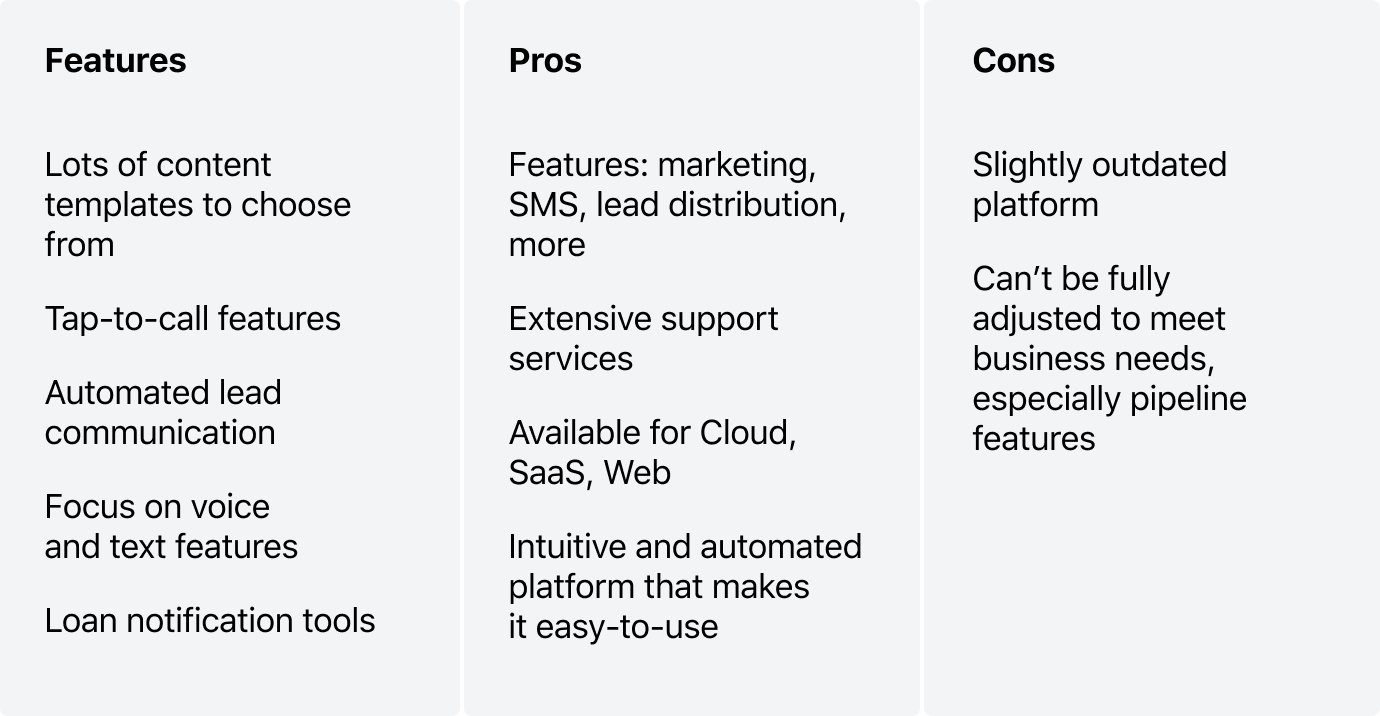

Pros and Cons

Here is a summary of the pros and cons of each of the leading CRM solutions for mortgage lenders:

Salesforce Financial Services Cloud* Pros: Comprehensive range of features, strong customer support, scalable

Cons

Expensive, complex to implement Microsoft Dynamics 365 for Finance and Operations* Pros: Comprehensive range of features, strong integration with other Microsoft products, scalable

Cons

Expensive, complex to implement Black Knight Loan Origination System (LOS)* Pros: Designed specifically for mortgage lenders, comprehensive range of features, strong customer support

Cons

Expensive, complex to implement Ellie Mae Encompass* Pros: Designed specifically for mortgage lenders, user-friendly, affordable

Cons

Limited range of features, not as scalable as other solutions Cloudvirga Mortgage CRM* Pros: Designed specifically for mortgage lenders, user-friendly, affordable

Cons

Limited range of features, not as scalable as other solutions

Best Practices for CRM Implementation

Implementing a CRM system for mortgage lenders requires a well-planned and executed approach. Here are some best practices to ensure a successful implementation:

To maximize the benefits of CRM technology, it is crucial to follow best practices during implementation. These include:

Data Migration

Data migration is a critical step in CRM implementation. It involves transferring data from existing systems into the new CRM system. To ensure a smooth migration, it is important to:

- Identify all relevant data sources and determine the data that needs to be migrated.

- Clean and prepare the data to ensure it is accurate and consistent.

- Develop a comprehensive data migration plan that Artikels the steps involved and the timeline for completion.

- Test the data migration process thoroughly before executing it.

User Training

User training is essential for successful CRM adoption. Mortgage lenders should provide comprehensive training to their employees on how to use the CRM system effectively. This training should cover:

- The basics of the CRM system, including its features and functionality.

- How to use the CRM system to manage customer relationships.

- How to use the CRM system to track and manage loan applications.

- How to use the CRM system to generate reports and analytics.

Process Optimization

CRM implementation provides an opportunity to optimize mortgage lending processes. Lenders should review their existing processes and identify areas where the CRM system can be used to improve efficiency and effectiveness. This may include:

- Automating tasks such as lead generation, lead qualification, and loan application processing.

- Streamlining communication with customers and partners.

- Improving data management and reporting.

Use Cases and Success Stories

Mortgage lenders worldwide have experienced significant improvements by implementing CRM systems. These success stories serve as valuable case studies, showcasing the benefits and ROI achieved. CRM technology has empowered lenders to streamline processes, boost productivity, and elevate customer satisfaction.

Case Study: ABC Mortgage Company

ABC Mortgage Company, a leading mortgage lender in the US, implemented a CRM system to enhance its customer relationship management. The system integrated all customer interactions, providing a comprehensive view of each borrower’s journey. As a result, ABC Mortgage experienced a remarkable increase in lead conversion rates, reduced loan processing time, and improved customer satisfaction scores.

Case Study: XYZ Mortgage Bank

XYZ Mortgage Bank, a regional lender in Europe, deployed a CRM system to streamline its loan origination process. The system automated tasks such as loan application processing, credit checks, and document management. By eliminating manual errors and speeding up the approval process, XYZ Mortgage Bank significantly reduced its operating costs and improved its overall efficiency.

Final Summary: Best Crm For Mortgage Lenders

Embracing the best CRM for mortgage lenders empowers businesses to transform their operations, elevate customer satisfaction, and drive exceptional results. By harnessing the power of technology, lenders can unlock a world of possibilities, propelling their organizations to new heights of efficiency and success.