Embark on a journey to discover the best CRM for insurance agencies. In this comprehensive guide, we will delve into the intricacies of CRM systems, empowering you to make informed decisions that will revolutionize your agency’s operations.

The insurance industry is constantly evolving, and having the right CRM system is crucial for agencies to stay competitive and provide exceptional customer service. With this guide, you will gain insights into essential features, vendor evaluation, implementation strategies, and the latest trends shaping the future of CRM in the insurance sector.

Market Landscape for CRM in Insurance Agencies

The insurance industry has witnessed a significant surge in the adoption of customer relationship management (CRM) solutions, driven by the need to enhance customer engagement, streamline operations, and gain a competitive edge.

According to a recent study by Forrester, the market share of CRM solutions within the insurance industry is projected to reach 30% by 2025, up from 20% in 2021. This growth is primarily attributed to the increasing demand for personalized customer experiences and the need for insurance agencies to adapt to the evolving digital landscape.

Adoption Rates of CRM Systems

The adoption rates of CRM systems among insurance agencies vary depending on the size and type of agency. Small and medium-sized agencies are more likely to adopt CRM systems than larger agencies, as they often have limited resources and need a cost-effective way to manage customer relationships.

According to a survey by the National Association of Insurance and Financial Advisors (NAIFA), 65% of small insurance agencies and 50% of medium-sized agencies use CRM systems. In contrast, only 35% of large insurance agencies use CRM systems.

Challenges in Selecting and Implementing CRM Systems

Insurance agencies face several challenges when selecting and implementing CRM systems. These challenges include:

- Data integration:Integrating CRM systems with existing insurance systems can be complex and time-consuming.

- Cost:CRM systems can be expensive to purchase and implement, especially for small and medium-sized agencies.

- User adoption:Getting insurance agents to adopt a new CRM system can be challenging, especially if they are not familiar with technology.

Core Features and Functionality

An effective CRM system for the insurance industry must possess a robust set of core features that cater to the specific needs of insurance agencies. These features provide the foundation for managing customer relationships, streamlining operations, and enhancing overall efficiency.

Essential features include contact management, lead tracking, policy management, and claims processing capabilities. Integration with other business systems, such as accounting and marketing automation, further enhances the functionality of a CRM system.

Contact Management

- Centralized storage and organization of customer information, including contact details, preferences, and interaction history

- Easy access to customer data for quick and personalized communication

- Segmentation and filtering capabilities to target specific customer groups

Lead Tracking

- Capture and qualification of potential customers

- Tracking of lead progress through the sales pipeline

- Automated lead nurturing and follow-up

Policy Management

- Comprehensive management of insurance policies, including policy details, coverage, and premiums

- Automated policy renewals and reminders

- Integration with underwriting systems for seamless policy issuance

Claims Processing

- Efficient handling of claims, including claim submission, investigation, and settlement

- Automated claim status updates and notifications

- Integration with third-party claims adjusters for expedited processing

Integration with Other Business Systems

- Seamless integration with accounting systems for accurate billing and revenue tracking

- Integration with marketing automation tools for targeted campaigns and lead generation

- Enhanced collaboration and data sharing across departments

Vendor Evaluation and Selection

Selecting the right CRM system is crucial for insurance agencies to maximize their efficiency and productivity. Here’s a framework to evaluate and select the best vendor:

Evaluate Vendors:

- Assess their offerings:Consider the features, functionality, and integrations offered by each vendor.

- Check their capabilities:Evaluate their technical expertise, industry knowledge, and customer support capabilities.

Factors to Consider:

- Cost:Determine the total cost of ownership, including software licensing, implementation, and maintenance.

- Scalability:Ensure the CRM system can grow with your agency’s needs and support future expansion.

- Vendor support:Evaluate the vendor’s responsiveness, availability, and quality of technical support.

Best Practices for Vendor Evaluation, Best crm for insurance agencies

Conduct vendor demos:Request live demonstrations to see the CRM system in action and ask specific questions about its capabilities.

Request references:Ask vendors for references from existing customers to gain insights into their experience and satisfaction.

Implementation and Adoption

Implementing a CRM system within an insurance agency is a crucial step towards improving operational efficiency and customer engagement. It involves several key considerations, including data migration, user training, and change management, to ensure successful adoption and utilization of the system.

Data Migration

Data migration involves transferring existing customer and policy data from legacy systems or spreadsheets into the new CRM system. This process requires careful planning and execution to ensure data integrity and minimize disruption during the transition. Agencies should consider the following:

Data Extraction

Determine the sources of data to be migrated and the methods for extracting it.

Data Cleansing

Cleanse and validate the data to remove duplicates, errors, and inconsistencies.

Data Mapping

Map the data fields from the legacy systems to the corresponding fields in the CRM system.

Data Loading

Import the cleansed and mapped data into the CRM system using appropriate tools and techniques.

User Training

Effective user training is essential for successful CRM adoption. Agencies should provide comprehensive training programs that cover the following aspects:

System Overview

Introduce the CRM system, its features, and benefits.

Workflow and Processes

Explain the workflows and processes within the CRM system and how they align with the agency’s business operations.

Practical Applications

Provide hands-on training on how to use the CRM system for various tasks, such as lead management, policy quoting, and customer service.

Continuous Support

Offer ongoing support and resources to users after the initial training to address any questions or issues they may encounter.

Change Management

Implementing a CRM system can bring about significant changes in the agency’s operations and workflows. To ensure a smooth transition, agencies should adopt a comprehensive change management strategy that includes:

Communication and Transparency

Communicate the reasons for implementing the CRM system and its expected benefits to all stakeholders.

Resistance Management

Anticipate and address potential resistance to change by involving users in the decision-making process and providing clear justifications for the new system.

Phased Implementation

Implement the CRM system in phases to minimize disruption and allow users to adapt gradually.

Feedback and Iteration

Regularly gather feedback from users and make adjustments to the system and implementation plan as needed.

Return on Investment (ROI) and Value

Implementing a CRM system in an insurance agency can yield significant returns on investment (ROI) by enhancing sales productivity, improving customer service, and streamlining operations.CRM systems enable insurance agents to manage customer relationships effectively, track sales pipelines, and automate tasks, leading to increased efficiency and productivity.

Enhanced customer service through personalized interactions, quick issue resolution, and proactive outreach results in improved customer satisfaction and loyalty. Streamlined operations through centralized data management, automated workflows, and improved collaboration reduce costs and improve overall agency performance.

Case Studies

ABC Insurance Agency

Implemented a CRM system to centralize customer data, automate lead management, and improve communication. Within a year, they experienced a 20% increase in sales revenue and a 15% reduction in operational costs.

XYZ Insurance Group

Used a CRM system to enhance customer service by providing personalized recommendations, tracking customer interactions, and resolving issues quickly. They reported a 12% increase in customer satisfaction and a 5% increase in policy renewals.

Emerging Trends and Innovations

The insurance industry is constantly evolving, and so are the technologies that support it. CRM systems are becoming increasingly sophisticated, and new trends are emerging that are specifically tailored to the needs of insurance agencies.

One of the most important trends is the rise of artificial intelligence (AI) and machine learning (ML). AI-powered CRM systems can automate many of the tasks that are traditionally done by humans, such as data entry, lead scoring, and customer segmentation.

This can free up insurance agents to focus on more strategic tasks, such as building relationships with clients and selling insurance products.

Another important trend is the increasing adoption of cloud-based CRM systems. Cloud-based CRM systems are more flexible and scalable than on-premise systems, and they can be accessed from anywhere with an internet connection. This makes them ideal for insurance agencies that have multiple locations or that need to access their CRM system remotely.

Innovative CRM Solutions

In addition to these general trends, there are a number of innovative CRM solutions that are specifically tailored to the needs of insurance agencies.

- Insurance-specific CRM systems:These systems are designed specifically for the insurance industry, and they include features that are specifically tailored to the needs of insurance agencies, such as policy management, claims processing, and underwriting.

- CRM systems with AI and ML capabilities:These systems use AI and ML to automate many of the tasks that are traditionally done by humans, such as data entry, lead scoring, and customer segmentation.

- Cloud-based CRM systems:These systems are more flexible and scalable than on-premise systems, and they can be accessed from anywhere with an internet connection.

Insurance agencies that are looking to improve their customer relationships and sales performance should consider investing in a CRM system that is tailored to their specific needs.

Ending Remarks: Best Crm For Insurance Agencies

In conclusion, selecting the best CRM for your insurance agency is a strategic investment that can transform your business. By following the guidance Artikeld in this guide, you can empower your team, streamline operations, and achieve unprecedented success. Embrace the power of CRM and unlock the full potential of your agency.

Helpful Answers

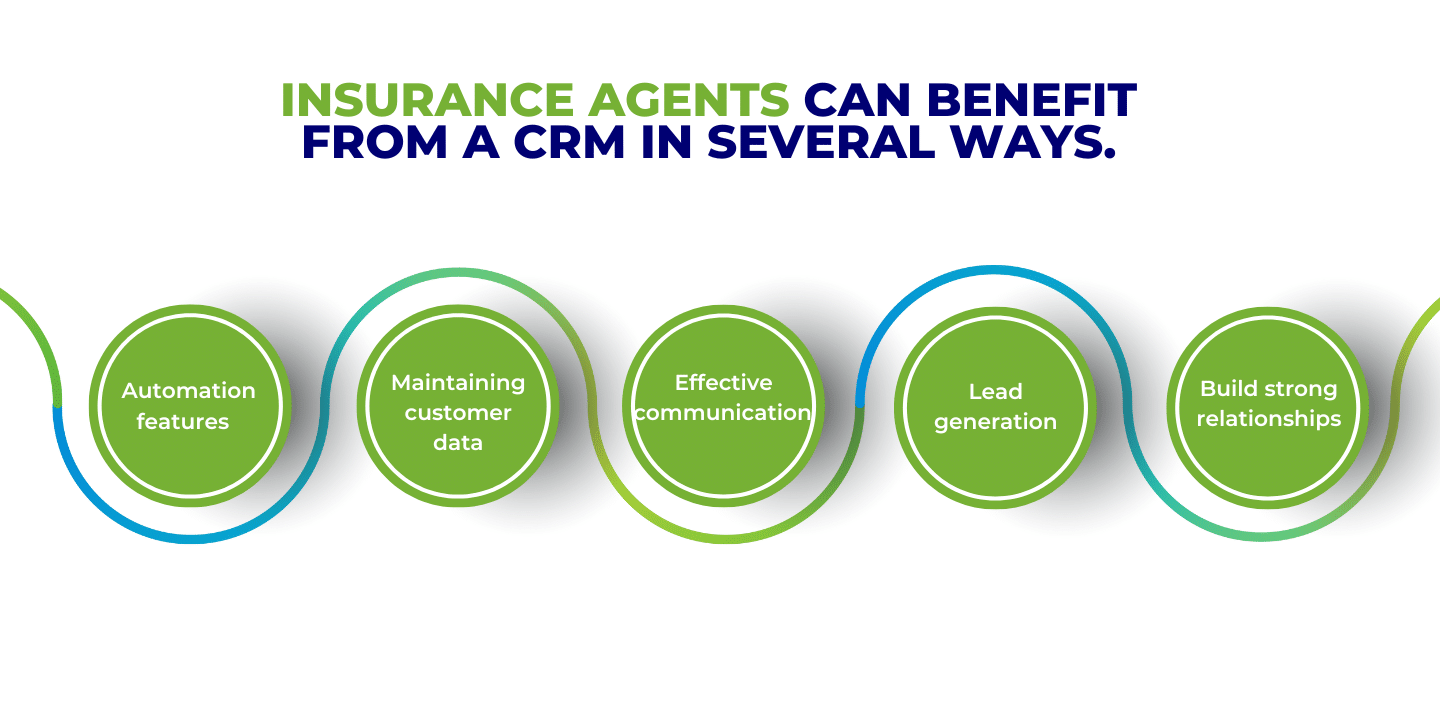

What are the key benefits of using a CRM for insurance agencies?

CRM systems offer numerous benefits for insurance agencies, including improved sales productivity, enhanced customer service, streamlined operations, and increased profitability.

How do I choose the right CRM vendor for my agency?

When selecting a CRM vendor, consider factors such as cost, scalability, vendor support, industry expertise, and the specific needs of your agency.

What are the best practices for implementing a CRM system?

Best practices for CRM implementation include data migration, user training, change management, and ongoing support to ensure successful adoption and utilization.