The world of capital raising just got a whole lot easier with the introduction of the best CRM for capital raising. This revolutionary tool is the key to unlocking a streamlined and efficient fundraising process. Dive in and discover how a CRM can transform your capital raising efforts.

With its robust features and intuitive design, the best CRM for capital raising empowers you to manage your fundraising pipeline, track investor relationships, and close deals faster. It’s the ultimate companion for organizations seeking to raise capital effectively and efficiently.

Overview of Capital Raising and the Role of CRM

Capital raising is the process of acquiring financial resources from investors to fund a business or project. It involves identifying potential investors, pitching the investment opportunity, and negotiating the terms of the investment. A CRM (Customer Relationship Management) system can play a crucial role in supporting capital raising efforts by managing investor relationships, tracking interactions, and automating communication.

Key Features and Functionalities of a CRM for Capital Raising

A CRM for capital raising typically offers the following features and functionalities:

- Investor database management: Store and organize information about potential and existing investors, including contact details, investment preferences, and relationship history.

- Deal pipeline management: Track the progress of capital raising deals, from initial contact to closing.

- Communication management: Automate email and phone communication with investors, send updates, and schedule meetings.

- Reporting and analytics: Generate reports on investor activity, fundraising progress, and other key metrics.

- Integration with other systems: Integrate with financial systems, email marketing platforms, and other business applications to streamline workflows.

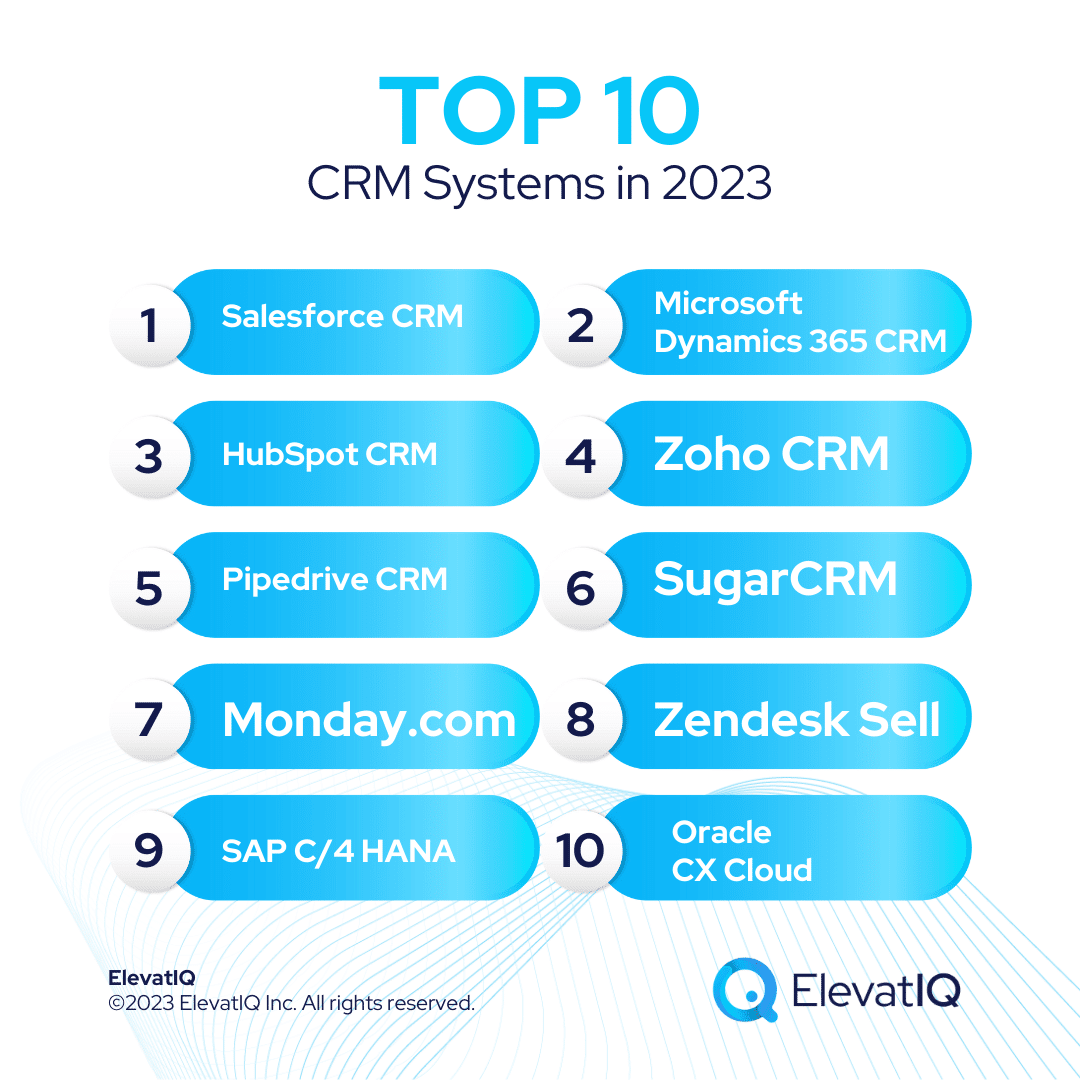

Market Landscape and Key Players: Best Crm For Capital Raising

The CRM market for capital raising is highly competitive, with numerous vendors offering a range of solutions. Key players include Salesforce, HubSpot, Zoho, Pipedrive, and Freshworks.

These providers offer a comprehensive suite of features designed to streamline the capital raising process, including contact management, lead tracking, fundraising pipeline management, and reporting.

Comparison of CRM Solutions

The following table compares the top CRM solutions for capital raising based on key features, pricing, and customer support:

| Feature | Salesforce | HubSpot | Zoho | Pipedrive | Freshworks |

|---|---|---|---|---|---|

| Contact Management | Comprehensive contact management with customizable fields and segmentation | Robust contact management with automated lead scoring and nurturing | Extensive contact management with multi-channel communication | Streamlined contact management with visual pipelines and drag-and-drop functionality | Centralized contact management with AI-powered insights |

| Lead Tracking | Advanced lead tracking with real-time notifications and customizable workflows | Automated lead tracking with lead scoring, nurturing, and qualification | Comprehensive lead tracking with lead scoring, segmentation, and lead nurturing | Visual lead tracking with drag-and-drop pipelines and customizable stages | AI-powered lead tracking with lead scoring, qualification, and predictive analytics |

| Fundraising Pipeline Management | Dedicated fundraising pipeline management with customizable stages and automated workflows | Fundraising pipeline management with investor tracking, pitch management, and reporting | Robust fundraising pipeline management with customizable stages, investor tracking, and reporting | Streamlined fundraising pipeline management with visual pipelines and drag-and-drop functionality | AI-powered fundraising pipeline management with predictive analytics and investor insights |

| Reporting | Comprehensive reporting with customizable dashboards and advanced analytics | Robust reporting with customizable dashboards, reports, and analytics | Extensive reporting with customizable dashboards, reports, and analytics | Visual reporting with drag-and-drop dashboards and customizable reports | AI-powered reporting with predictive analytics and investor insights |

| Pricing | Enterprise-level pricing with customizable plans | Tiered pricing with flexible options | Affordable pricing with flexible plans | Subscription-based pricing with flexible options | Flexible pricing with customizable plans |

| Customer Support | 24/7 customer support with dedicated account managers | 24/7 customer support with live chat, email, and phone support | 24/7 customer support with live chat, email, and phone support | 24/7 customer support with live chat, email, and phone support | 24/7 customer support with live chat, email, and phone support |

Best Practices for CRM Implementation in Capital Raising

Effective CRM implementation is crucial for successful capital raising. Here are best practices to guide you through the process.

Steps Involved in CRM Implementation for Capital Raising

- Define Objectives:Determine specific goals for CRM implementation, such as improved lead generation, pipeline management, and investor relationships.

- Choose the Right CRM:Evaluate different CRM systems based on features, scalability, and integration capabilities.

- Data Management:Establish data collection and management protocols to ensure accurate and up-to-date information.

- Lead Generation:Integrate marketing automation tools and leverage social media to generate qualified leads.

- Pipeline Management:Create a structured pipeline to track leads through different stages of the capital raising process.

- Reporting and Analytics:Regularly monitor CRM data to identify trends, optimize strategies, and improve decision-making.

Best Practices for Data Management, Lead Generation, and Pipeline Management

Data Management:

- Centralize investor data in a single repository.

- Regularly clean and verify data to ensure accuracy.

- Establish data governance policies to maintain data integrity.

Lead Generation:

- Use targeted marketing campaigns to attract qualified prospects.

- Leverage social media platforms for lead generation.

- Implement lead scoring systems to prioritize high-potential leads.

Pipeline Management:

- Define clear stages and milestones in the capital raising pipeline.

- Assign responsibilities and track progress for each stage.

- Use CRM dashboards and reporting tools to monitor pipeline performance.

Case Studies of Successful CRM Implementations in Capital Raising

Case Study 1:

- Company X implemented a CRM system that integrated with their marketing automation platform.

- The CRM helped them generate 20% more qualified leads.

- The improved lead quality resulted in a 15% increase in closed deals.

Case Study 2:

- Company Y used a CRM to manage their pipeline and track investor interactions.

- The CRM enabled them to identify potential investors and nurture relationships.

- Company Y successfully raised $50 million in capital within six months of implementing the CRM.

Evaluation and Selection Criteria

When evaluating CRM solutions for capital raising, it’s crucial to consider specific criteria to ensure alignment with your organization’s needs and objectives. A comprehensive evaluation process helps identify the most suitable CRM system that can effectively support your capital raising efforts.

Here’s a checklist to guide your evaluation and comparison of different CRM systems:

Scalability

- Assess the system’s ability to handle increasing data volumes and user base as your capital raising operations expand.

- Consider the CRM’s capacity to accommodate additional modules, integrations, and customizations in the future.

Security

- Ensure the CRM complies with industry-standard security protocols to protect sensitive investor and financial data.

- Evaluate the system’s data encryption, access controls, and disaster recovery capabilities.

Integration Capabilities

- Determine the CRM’s ability to integrate with other business systems, such as accounting software, email marketing platforms, and document management systems.

- Consider the availability of pre-built integrations or the ease of custom integration to streamline data flow and enhance efficiency.

Additional Considerations

- Evaluate the CRM’s user-friendliness, reporting capabilities, and customer support to ensure a positive user experience.

- Consider the vendor’s reputation, industry experience, and financial stability to ensure long-term support and reliability.

Future Trends and Innovations

The realm of CRM technology for capital raising is poised for transformative advancements. Emerging trends and innovations are reshaping the landscape, introducing cutting-edge capabilities that enhance efficiency, effectiveness, and data-driven decision-making.

Artificial Intelligence (AI)

AI is revolutionizing CRM systems, enabling them to automate repetitive tasks, provide personalized recommendations, and analyze vast amounts of data to identify trends and patterns. AI-powered chatbots can engage with potential investors, qualify leads, and schedule appointments, freeing up fundraising teams to focus on high-value interactions.

Automation

Automation streamlines workflows and eliminates manual processes, saving time and reducing errors. CRM systems with robust automation capabilities can automate tasks such as sending follow-up emails, generating reports, and tracking investor activity. This allows fundraising teams to allocate more time to relationship-building and closing deals.

Data Analytics, Best crm for capital raising

Data analytics provides valuable insights into investor behavior, fundraising trends, and pipeline performance. CRM systems equipped with advanced analytics capabilities can track key metrics, generate reports, and identify areas for improvement. This data-driven approach enables fundraising teams to make informed decisions and optimize their strategies.

Last Point

In the ever-evolving landscape of capital raising, a CRM is no longer a luxury but a necessity. By embracing the best CRM for capital raising, you gain a competitive edge, optimize your fundraising strategy, and maximize your chances of success.

Invest in the right CRM today and unlock the full potential of your capital raising endeavors.